Gilmore & Bell, P.C.

02/02/2022

(Published in The McPherson Sentinel on February 27, 2022)

ORDINANCE NO. 3368

AN ORDINANCE OF THE CITY OF MCPHERSON ESTABLISHING THE MCPHERSON HOTEL DEVELOPERS COMMUNITY IMPROVEMENT DISTRICT; AUTHORIZING THE MAKING OF CERTAIN PROJECT IMPROVEMENTS RELATING THERETO; APPROVING THE ESTIMATED COSTS OF SUCH PROJECT IMPROVEMENTS; LEVYING A 2.00% CID SALES TAX; AND PROVIDING FOR THE METHOD OF PAYMENT OF THE PROCEEDS PURSUANT TO A DEVELOPMENT AGREEMENT RELATING THERETO.

WHEREAS, pursuant to K.S.A. 12-6a26 et seq., as amended (the “CID Act”), cities are authorized to create community improvement districts as a method of financing economic development related improvements in a defined area within the city; and

WHEREAS, the City of McPherson, Kansas (the “City”) is a city within the meaning of the Act; and

WHEREAS, a petition (the “Petition”) was filed with the City proposing the creation of a community improvement district pursuant to the Act to be known as the McPherson Hotel Developers Community Improvement District (the “District”), the completion of a project relating thereto as more particularly described herein (the “Project”) and the imposition of a CID Sales Tax in the amount of 2.00% (the “CID Sales Tax”) in order to pay a portion of the costs of the Project; and

WHEREAS, the Petition was signed by the owners of one hundred percent (100%) of all land and all of the assessed value within the proposed District, exclusive of land owned by the City for infrastructure purposes; and

WHEREAS, the CID Act provides that prior to creating any CID, the Governing Body shall, by resolution, direct and order a public hearing on the advisability of creation of such CID and the construction and expenditure of costs of community improvement district projects relating thereto, and give notice of the hearing by publication once each week for two consecutive weeks in the official City newspaper, the second publication to be at least seven days prior to the hearing, and by the mailing of notice to the owners of property within the proposed CID; and

WHEREAS, the Governing Body adopted Resolution No. 21-17 (the “Resolution”) on December 13, 2021, directing that a public hearing on the proposed District be held on January 4, 2022, and requiring that the Clerk provide for notice of such public hearing as set forth in the Act; and

WHEREAS; the Resolution was published once each week for two consecutive weeks in the newspaper and mailed by United States certified mail, return receipt requested, to each owner or owners of record, whether resident or not, of real property within the proposed District, and notice of the public hearing was given to the occupants of the District that are known to the City; and

WHEREAS, the CID Act further authorizes the City, in order to pay the costs of such projects, to impose a community improvement district sales tax on the selling of tangible personal property at retail or rendering or furnishing of taxable services within a CID in any increment of .10% or .25% not to exceed 2.0% and to reimburse the costs of community improvement district projects from community improvement district sales tax; and

WHEREAS, on January 4, 2022, the Governing Body conducted a public hearing on the proposed District, the proposed Project related thereto, the method of financing the same and the imposition of the CID Sales Tax; and

WHEREAS, the Governing Body hereby finds and determines it to be advisable to create the District and set forth the boundaries thereof, authorize the Project relating thereto, approve the maximum costs of such community improvement district projects, approve the method of financing the same and impose the CID Sales Tax, all in accordance with the provisions of the CID Act; and

WHEREAS, the City and McPherson Hotel Developers, LLC have executed a Development Agreement, dated as of February 1, 2021 (the “Development Agreement”) relating to the development of the proposed Project, the distribution of the CID Sales Tax and related matters.

NOW THEREFORE, BE IT ORDAINED BY THE GOVERNING BODY OF THE CITY OF MCPHERSON, KANSAS:

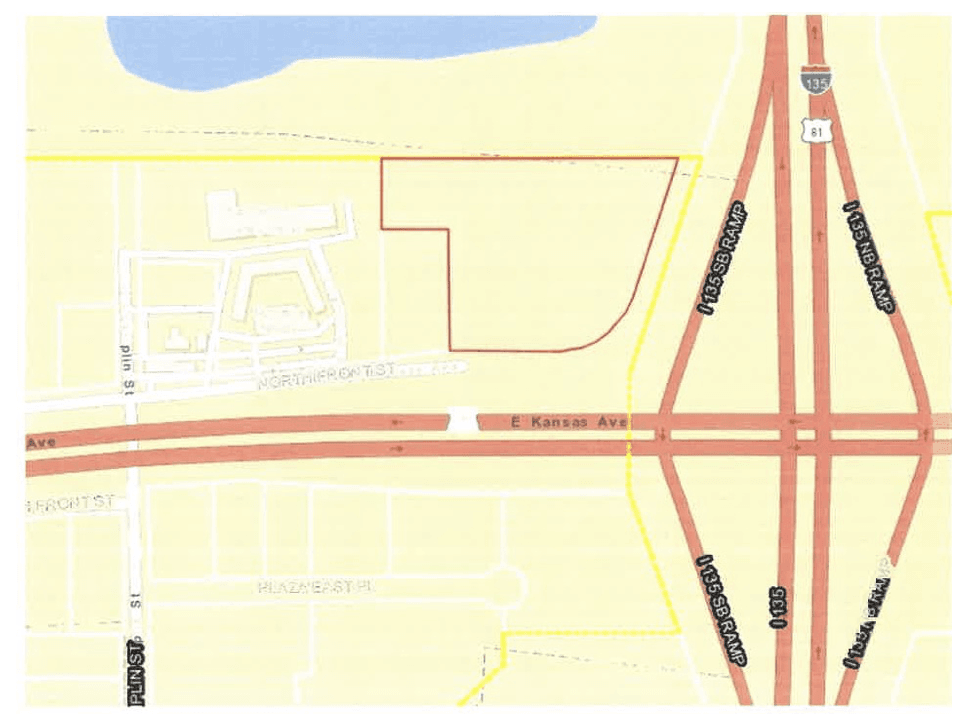

Section 1. Creation of the District. The Governing Body hereby finds and determines that the Petition is sufficient and that all notices required to be given under the CID Act were given in accordance with the CID Act. The Governing Body hereby creates the McPherson Hotel Developers Community Improvement District within the City and approve the boundaries thereof (the “District”). A legal description of the property within the District is set forth in Exhibit A attached hereto and incorporated by reference. A map generally outlining the boundaries of the District is attached hereto as Exhibit B and incorporated herein by reference.

Section 2. Authorization of Project. The Project described in the Petition consists of the construction of an approximately 92-room Candlewood Suites (extended stay) hotel and development of two retail pad sites as food service providers (the “Project”). The Governing Body hereby approves the Project.

Within the District, there may be construction of any of the following:

- sidewalks on public right-of-way, streets, roads, interchanges, highway access roads, intersections, traffic signs and signals, utilities, pedestrian amenities, drainage systems, water systems, storm systems, sewer systems, public lift stations, underground gas, heating and electrical services and connections located within or without the public right-of-way, water mains and extensions and other site improvements;

- streetscape, lighting, street light fixtures, street light connections, street light facilities in the public right-of-way;

- lawns, trees and other landscape in the public right-of-way; and

- underground fire-related water lines and appurtenances thereto.

Section 3. Estimated Cost. The estimated cost of the Project to be completed within the District is $14,700,000. Proceeds from the CID Sales Tax may be used to reimburse up to a maximum of $2,559,994 of the costs of the Project, including capital costs for the Project incurred not earlier than one (1) year prior to the adoption of the Resolution. A list of the eligible expenses to be reimbursed with proceeds of the CID Sales Tax is set forth on Exhibit C hereto.

Section 4. Method of Financing. The Project will be financed on a pay-as-you-go basis from revenues received from the imposition the CID Sales Tax on the selling of tangible personal property at retail or rendering or furnishing services taxable pursuant to the provisions of the Kansas retailers’ sales tax act within the District. There will be no special assessments levied pursuant to the CID Act and there will be no bonds issued pursuant to the CID Act.

Section 5. Imposition of the Community Improvement District Sales Tax. In order to provide for the payment of a portion of the costs of the Project on a pay-as-you-go basis, the Governing Body hereby imposes the CID Sales Tax within the District in an amount of 2.00% on the sales of tangible personal property at retail or rendering or furnishing services taxable pursuant to the Kansas retailers’ sales tax act within the District. The Clerk shall cause all notices required by the CID Act to be given following passage of this ordinance, specifically including the submittal by the City of a certified copy of this ordinance to the Kansas Department of Revenue (“KDOR”) following publication hereof. Such CID Sales Tax shall commence on the first day of the calendar quarter next following the 90th day after receipt by the KDOR of the certified copy of this Ordinance sent by the City and remain in effect for 22 years, or such lesser period as may be required for payment from CID Sales Tax revenues of the costs approved for the Project in Section 3, above, whichever is the lesser period.

Section 6. Collection of the Sales Tax. The collection of the CID Sales Tax shall be made in the manner presented in the CID Act.

Section 7. Segregation of the Sales Tax Revenues. All revenues derived from the collection of the CID Sales Tax shall be deposited into a special fund of the City to be designated as the McPherson Hotel Developers CID Sales Tax Revenue Fund. Such revenues shall be used to pay a portion of the costs of the Project on a pay-as-you-go basis and related expenses described in Section 3, above.

Section 8. Further Authority. The City shall, and the officers, employees and agents of the City, including Gilmore & Bell, P.C., the City's bond counsel, are hereby authorized and directed to, take such action, expend such funds and execute such other documents, certificates and instruments, as may be necessary or desirable to carry out and comply with the intent of this Ordinance and to carry out, comply with and perform the duties of the City with respect thereto.

Section 9. Effective Date. This Ordinance shall take effect from and after its passage by the Governing Body, and its publication once in the official newspaper of the City.

[BALANCE OF THIS PAGE INTENTIONALLY LEFT BLANK]

PASSED by the City Commission of the City of McPherson, Kansas on February 21, 2022 and SIGNED by the Mayor.

(SEAL) /s/Thomas A. Brown

Mayor

ATTEST:

s/s Britta Erkelenz

City Clerk

[BALANCE OF THIS PAGE INTENTIONALLY LEFT BLANK]

CERTIFICATE

I, the undersigned, hereby certify that the above and foregoing is a true and correct copy of the original Ordinance No. 3368 (the “Ordinance”) of the City of McPherson, Kansas (the “City”); that said Ordinance was passed by the City Commission on February 21, 2022, that the Ordinance was published in the official newspaper of the City on February 27, 2022; and that the Ordinance has not been modified, amended or repealed and is in full force and effect as of this date.

DATED: February 27, 2022.

/s/ Britta Erkelenz

City Clerk

[BALANCE OF THIS PAGE INTENTIONALLY LEFT BLANK]

EXHIBIT A

Legal Description of District

The following described real estate in the County of McPherson, State of Kansas:

ALL OF LOT THREE (3), BLOCK TWO (2), CHAMPLIN ADDITION TO THE CITY OF MCPHERSON, EXCEPT A PORTION OF LOT 3, BLOCK 2, DESCRIBED AS FOLLOWS:

BEGINNING AT THE SOUTHWEST CORNER OF SAID LOT 3, THENCE NORTH 200 FEET ALONG THE WEST BORDER OF SAID LOT 3 TO A POINT; THENCE EAST 170 FEET; THENCE SOUTH APPROXIMATELY 200 FEET PARALLEL TO THE WEST BORDER OF SAID LOT 3 TO THE SOUTH LINE OF SAID LOT 3; THENCE WESTERLY APPROXIMATELY 170 FEET ALONG THE NORTH RIGHT OF WAY LINE OF NORTH FRONT STREET, THE SAME BEING SOUTH LINE OF SAID LOT 3 TO THE POINT OF BEGINNING, MCPHERSON COUNTY, KANSAS.

EXCEPT PART OF LOT THREE (3), BLOCK TWO (2), CHAMPLIN ADDITION TO THE CITY OF MCPHERSON, DESCRIBED AS FOLLOWS:

COMMENCING AT THE SOUTHWEST CORNER OF SAID LOT 3, THENCE NORTH 200 FEET ALONG THE WEST BORDER OF SAID LOT 3 TO THE POINT OF BEGINNING; THENCE CONTINUING NORTH ALONG THE WEST BORDER OF SAID LOT 3, 127 FEET; THENCE EAST 170 FEET; THENCE SOUTH PARALLEL TO THE WEST BORDER OF SAID LOT 3 127 FEET; THENCE WEST 170 FEET TO THE POINT OF BEGINNING, MCPHERSON COUNTY, KANSAS.

EXHIBIT B

MAP OF DISTRICT

(Proposed District Boundaries Outlined in Red)